kentucky sales tax on vehicles

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. This page describes the taxability of.

Are services subject to sales tax in Kentucky.

. Kentucky applies a 6 sales tax to all car sales whether the car youre purchasing is brand new or used. The tax is levied on the privilege of using a motor vehicle on the public highways of Kentucky based on the vehicles retail price. Sales and Use Tax Laws.

For Kentucky it will always be at 6. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of.

2 Motor vehicles which are not subject to the motor vehicle usage tax established in KRS 138460 or the U-Drive-It tax established in KRS 138463 shall be. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. He also said he is working on legislation that would cut the states sales tax from 6 to 5 from July 1 2022 through June 30 2023.

Is the usage tax refundable if an individual titles a salvage vehicle and pays Motor Vehicle Usage. The state of Kentucky has a flat sales tax of 6 on car sales. Claimed compensation line 2 Deduct 175 of the first 1000 and 15 of the amount in excess of 1000 with a 50 cap.

The tax is paid to the county clerk when the vehicle is titled. You can find these fees further down on the page. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees.

There are no local sales and use taxes in Kentucky. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title. Please note that special sales tax laws.

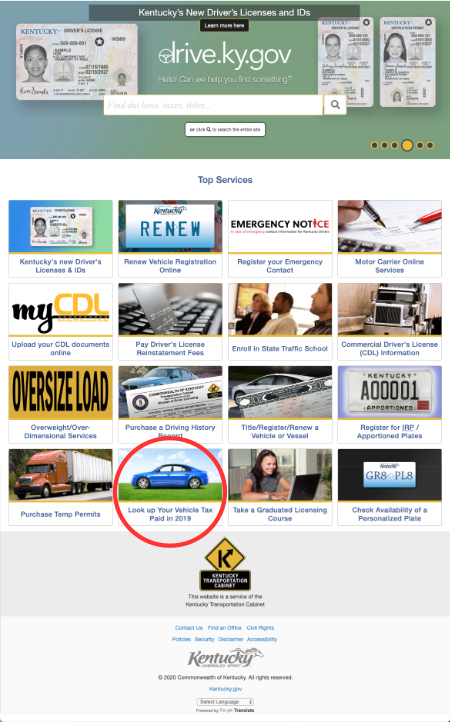

Motor Vehicle Usage Tax Sales Tax Use Tax May 1 2014. Relative Content The Kentucky Transportation Cabinet is responsible for all title and watercraft related. Every year Kentucky taxpayers pay the price for driving a car in Kentucky.

Fortunately where you are in Kentucky doesnt really matter since. Used car values in Kentucky. Kentucky has a 6 statewide sales tax rate but also has 211 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008.

Our free online Kentucky sales tax calculator calculates exact sales tax by state county city or ZIP code. The tax would be levied at the rate of 6 of the gross receipts derived from the. Kentucky Governor Andy Beshear issued an executive order on February 16 2022 intended to stop an increase in vehicle property taxes for 2022.

Andy Beshear signed an executive order freezing the taxable value of motor vehicles in Kentucky for two years and he proposed a one-year cut in the state sales tax from. Depending on where you live you pay a percentage of the cars assessed value a price set by. Be subject to the sales or use tax.

How to Calculate Kentucky Sales Tax on a Car. This tax is collected upon the transfer of ownership or when a vehicle is offered for registration for the first time in Kentucky. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. B rental of a vehicle. A rental of a shared vehicle by a peer-to-peer car sharing company.

Kentucky does not charge any additional local or use tax. Gross Kentucky sales and use tax line 1 x 06. 16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global pandemic Gov.

While Kentuckys sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price.

Andy Beshear announced today that he is.

What S The Car Sales Tax In Each State Find The Best Car Price

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Motor Vehicle Taxes Department Of Revenue

Nj Car Sales Tax Everything You Need To Know

Rising Value Of Vehicles May Lead To Property Tax Increase In Kentucky News Wdrb Com

Old Illinois License Plate Tag White Blue Mk3845 Auto Garage Etsy License Plate Vintage License Plates Garage Decor

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Come Test Drive This 2014 Buick Lacrosse Contact Us For More Information Http Www Penskebuickgmc Com 2014 Lacrosse Special Buick Lacrosse Buick Buick Gmc

Which U S States Charge Property Taxes For Cars Mansion Global

Car Sales Tax In Kentucky Getjerry Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Sales Tax In Kentucky Getjerry Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Rising Value Of Vehicles May Lead To Property Tax Increase In Kentucky News Wdrb Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Sales Tax In Kentucky Getjerry Com

Click To Close Image Click And Drag To Move Use Arrow Keys For Next And Previous Diecast Toy Cars Remote Control Trucks